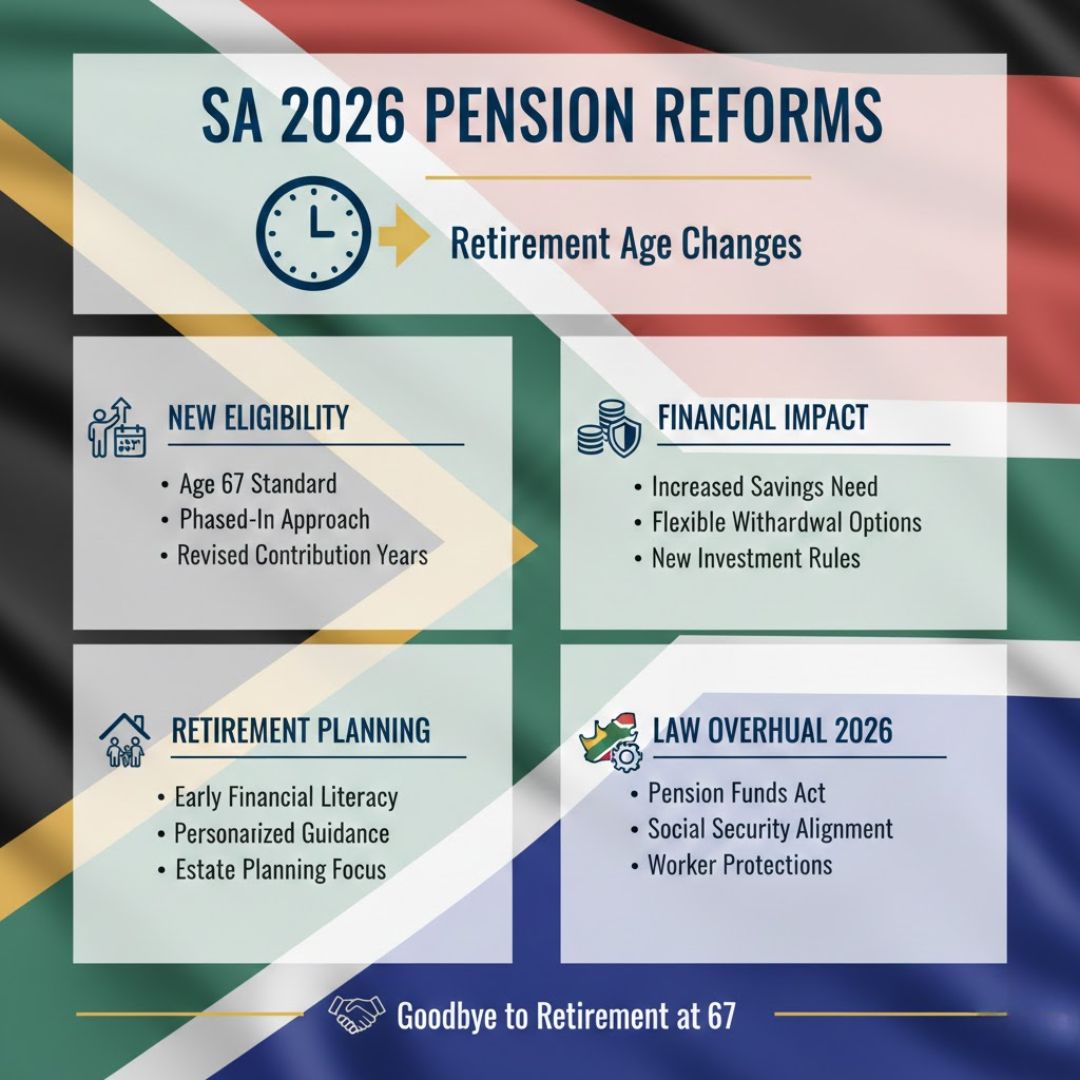

The retirement age was established decades ago when life expectancy was much shorter and people were not anticipated to need income for extended periods after leaving the workforce. Currently many South African citizens maintain good health and remain productive well beyond their late sixties. Financial challenges such as inflation & increasing healthcare expenses have made fixed retirement ages impractical for numerous families. The 2026 pension legislation has eliminated rigid retirement age requirements & now emphasizes personal choice and individual situations. Seniors no longer face mandatory retirement at 67 but can make their own decisions based on their health status and financial needs & their desire to continue working. These modifications enable older people to remain economically engaged in ways that suit their personal circumstances best.

How Pension Reforms Are Shaping Elderly Benefits

The latest changes ensure that older South Africans continue to receive pension benefits once they meet the necessary criteria. These reforms aim to support the long-term sustainability of senior support systems while encouraging those who wish to delay retirement beyond the traditional age. The new rules offer more flexibility for retirees, aligning benefit structures with modern employment choices.

Greater Flexibility for Workers and Employers

These policy updates bring more freedom and dignity to individuals by letting them choose when to retire. Instead of being forced into retirement, older workers can now remain employed if they wish. This also benefits employers who can continue to rely on skilled and experienced staff, maintain institutional knowledge, and reshape job roles to accommodate an aging workforce.

The Rising Need for Thoughtful Retirement Planning

Retirement planning has become a more flexible journey in recent years. Rather than sticking to a single retirement age, people can now exit the workforce at a time that suits their life circumstances. This shift requires individuals to plan ahead carefully and make informed decisions about when and how to retire, taking control of their financial and personal future.

South Africa Banking Rules Tighten as New Cash Withdrawal Limits Begin From February 2 Nationwide

South Africa Banking Rules Tighten as New Cash Withdrawal Limits Begin From February 2 Nationwide

Broad Economic and Social Implications

South Africa has taken a bold first step toward comprehensive aging reforms. Older policies based on strict age limits have been phased out. The current framework supports the idea that older employees remain valuable contributors to both the economy and society. These updates highlight the role of active senior participation in the workforce, offering a balanced approach that reflects modern realities and promotes social inclusion.

Retirement Age Officially Extended to 67

Under the new 2026 pension laws, retirement eligibility now extends to age 67, signaling a shift toward a more adaptable retirement system. This change enhances choices for seniors and contributes to a more sustainable pension framework for the future. It reflects evolving views on aging, employment, and long-term financial planning in South Africa.